10 Key Stock market indicators every trader should know

Using trading indicators is part of any technical provider’s approach. Paired with the right risk control tools, it is in a position to help you gain extra perception into price trends. Let’s discover 10 of the great buying and selling indicators.

Trading indicators explains

Whether you’re interested in forex trading, commodities trading or share trading, it can be helpful to use technical analysis as part of your strategy – and this includes studying various trading indicators. Trading indicators are mathematical calculations, which might be plotted as traces on a price chart and might assist customers perceive sure alerts and indicate inside the market.

There are different type of buying and selling indicator, which includes leading indicators and lagging indicator. A most leading indicator is a forecast indicator that predicts future price moves, and lagging indicator appears at past trends and indicates momentum.

Best trading indicators

1. Moving Average (MA)

2. Exponential Moving Average (EMA)

3. Stochastic oscillator

4. Moving Average convergence divergence (MACD)

5. Bollinger bands

6. Fibonacci retracement

7. Relative strength index (RSI)

8. Average directional index

9. Standard deviation

10. Ichimoku cloud

You can use your knowledge and risk appetite as a measure to decide which of these trading indicators best suit for your strategy. Note that the indicators listed here are not ranked, but they are some of the most popular choices for retail traders.

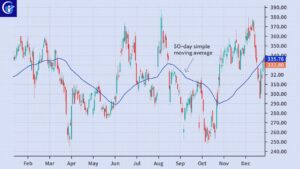

1.Moving Average (MA)

The MA – or ‘simple moving common’ (SMA) – is a trademark used to perceive the course of a current price trend, without the interference of shorter-time period price spikes. The MA indicator combines price factors of a monetary instrument over a detailed time frame and divides it with the aid of way of the sort of statistics elements to present a single trend line.

The data used depends at the length of the MA. For example, a 200-day MA calls for 2 hundred days of records. By using the MA indicator, you could have a take a look at support and resistance and see previous price movement (the records of the market). This way you could moreover decide viable future patterns.

2.Exponential moving average(EMA)

EMA is some other form of moving average. Unlike the SMA, it places a extra weight on recent data point, making data more responsive to new information. When used with one-of-a-kind indicators ,EMAs can assist buyers confirm massive marketplace movements.

The maximum well-known exponential moving averages are 12- and 26-day EMAs for short-term averages, whereas the 50- and 200-day EMAs are used as long-time period trend indicators.

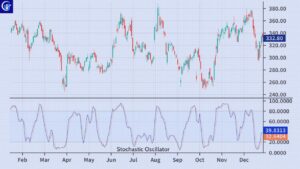

3.Stochastic oscillator

A stochastic oscillator is an indicator that compares a particular final price of an asset to some of its prices over time – displaying momentum and trend power. It makes use of a scale of 0 to 100. A reading under 20 generally represents an oversold marketplace and a analysis above 80 an overbought market. However, if a strong trend is present, a correction or rally will not necessarily take place.

4.Moving Average convergence divergence (MACD)

MACD is an indicator that detects changes in momentum by using the use of comparing two moving averages. It can assist buyers find out possible buy and promote opportunities round manual and resistance ranges.

‘Convergence’ manner that two moving averages are coming together, while ‘divergence’ technique that they’re moving far from each other. If moving averages are converging, it means momentum is decreasing, while if the moving averages are diverging, momentum is increasing.

5.Bollinger bands

A Bollinger band is a indicator that gives a selection inside which the fee of an asset generally trades. The width of the band will increase and decreases to reflect brand new volatility. The closer the bands are to every different – or the ‘narrower’ they’ll be – the lower the perceived volatility of the economic tool. The wider the bands, the higher the perceived volatility.

Bollinger bands are beneficial for recognizing at the same time as an asset is buying and selling outside of its normal tiers, and are used commonly as a way to are waiting for prolonged-time period price moves. When a price constantly actions out of doors the pinnacle parameters of the band, it may be overbought, and even as it movements under the lower band, it could be oversold.

6.Fibonacci retracement

Fibonacci retracement is an indicator that may pinpoint the level to which a marketplace will move in competition to its present day trend. A retracement is when the market reviews a temporary dip – it’s also called a pullback.

Traders who think the market is set to make a moves use Fibonacci retracement to confirm this. This is as it allows to perceive possible ranges of support and resistance, that can indicate an upward or downward trend. Because traders can choose out level of support and resistance with this indicator, it can help them decide where to use stops and limits, or when to open and close to their positions.

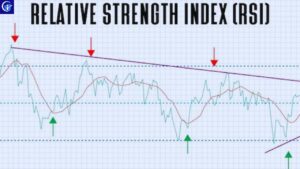

7.Relative strength index (RSI)

RSI is extensively talking used to assist traders become aware of momentum, market conditions and caution alerts for volatile charge movements. RSI is expressed as a discern between 0 and 100. An asset around the 70 level is frequently taken into consideration overbought, at the same time as an asset at or close to 30 is regularly taken into consideration oversold.

An overbought signal indicates that short-term earnings can be attaining a point of adulthood and belongings can be in for a price correction. In contrast, an oversold signal could mean that short-time period declines are reaching maturity and assets may be in for a rally.

8.Average directional index (ADX)

The ADX illustrates the strength of a price trend. It works on a scale of 0 to 100, where a analysis of more than 25 is taken into consideration a strong trend, and a number of below 25 is taken into consideration a drift. Traders can use this statistics to accumulate whether or now not an upward or downward style is in all likely to continue.

ADX is generally based mostly on a moving average of the price range over 14 days, relying on the frequency that buyers determine on. Note that ADX in no way shows how a price trend would probably develop, it really shows the strength of the trend. The average directional index can upward ,when a price is falling, which signals a strong downward trend.

9.Standard deviation

Standard deviation is a indicator that allows traders levels the dimensions of price actions. Consequently, they could pick out how in all likely volatility is to affect the price within the future. It cannot predict whether the price will go up or down, only that it will be affected by volatility.

Standard deviation compares current-day price movements to historical price actions. Many traders accept as true with that large price movements study small price moves, and small price moves comply with massive price movements.

10.Ichimoku cloud

The Ichimoku Cloud, like many different technical indicators, identifies support and resistance levels. However, it additionally estimates price momentum and provides traders with signal to help them with their decision-making. The translation of ‘Ichimoku’ is ‘one-appearance equilibrium chart’ – this is exactly why this indicator is used by traders who need some of information from one chart.

In a nutshell, it identifies market trends, showing current support and resistance levels, and additionally forecasting future stages.

What you want to understand earlier than using trading indicators.

The first rule of the use of buying and selling indicator is that you need to by no means use a indicator in isolation or use too many indicator right away. Focus on some which you assume are great suitable to what you’re in search of to attain. You need to additionally use technical indicators alongside your own assessment of the moves of an asset’s price through the years .

It’s crucial to consider that you need to confirm a indicator up some way. If you’re getting a ‘buy’ signal from a indicator and a ‘ Sell’ signal from the price action, you need to apply different indicator, or different time frames till your signal are confirmed.

Another thing to keep in mind is which you need to in no way lose sight of your trading plan. Your rules for trading should always be implemented when as the use of indicator.

3 thoughts on “10 Key Stock market indicators every trader should know”